While the Sioux Falls area has experienced an unprecedented amount of unfortunate storms this year, our local real estate market has brewed up a perfect storm of opportunity.

Mortgage rates recently popped into the high fives — and low sixes for a hot second — in the past couple of weeks, which has brought more buyers into the market and, for a very pleasing twist, a lot more sellers too. Interest rates did cool off last week and have remained pretty stable in the low fives — a very comfortable rate.

She, whom I call the real estate market, took a breath when the rates increased. Since we haven’t seen a mortgage rate starting with a five since 2011, it only made sense for a tiny pause. This small holding pattern felt a lot like the real estate market at the end of March 2020: the eerily unknown. Then, similar to 2020, she exhaled –this time bringing more inventory too.

With more homes hitting the market each day, this gives buyers an amazing edge they have not had since early 2020. We are screaming it from the mountaintops. Buyers who have lost out on a myriad of homes because of multiple offers are going under contract. It is blissful!

Amy Stockberger Real Estate will be putting more inventory on the market in the next two weeks than we have in a long time. I imagine the same is true for other brokerages citywide. This increase of opportunities for our clients is wildly exhilarating.

Home values are still up 19 percent year to date and leveling off a tish but not going backward — balancing the market but not stopping appreciation by any means. Be wary of just reading national news headlines — dig into the entire article. While we know inflation can cause recessions of sorts, keep in mind this is not a housing recession. And remember there is no such thing as a national real estate market. As much as the national media tries to lump the entire real estate industry as a whole into one big market, there is no way that exists.

Our beautiful slice of heaven is still attracting an unprecedented amount of relocating families. They are still coming here for opportunity and freedom. A 5 percent interest rate is not changing that. Housing is essential, and people’s lives change regardless of the market conditions. The government can’t stop the normal life cycle and rights of passage humans experience that are directly related to housing. Getting married, getting divorced, getting a promotion, losing a job, having a child or more children, having children leave the nest — all of these life changes are parallel to where they will live.

In an economy where prices for groceries, gasoline, nearly all products and services are volatile and dynamic, a mortgage is a fabulous investment. It’s a locked-in payment you can depend on not changing each month. You can’t say that about rentals. Rental prices have exceeded home pricing increases and likely won’t be stopping any time soon.

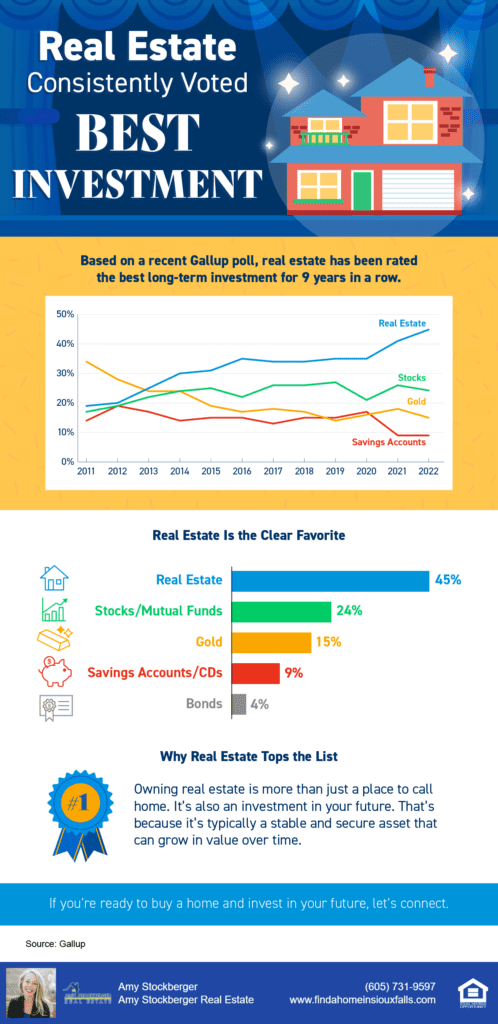

This brings a fabulous opportunity for investors right now too. Increases in inventory matched by rising rental rates creates one the best investments you can have — far better than the majority of stocks and bonds that have crippled many people’s retirements recently. Real estate is the best investment you can make now and likely for the next decade plus.

Waiting to invest or move up or down will cost you far more next year than today. Our housing prices will continue to go up, and you will likely pay tens of thousands and likely far more for a home or investment next year, even with a 5 percent mortgage rate. Economists are speculating that rates will be in the fours again by this time next year, which means you can easily refinance your mortgage at that time. Home pricing affordability has never caused a housing crisis all on its own.

One of our core values revolves around building big, juicy legacies for our clients, our agents and our staff, and wealth through real estate is so easy in our market. If you want to know what buying, selling and investing looks like right now in our delicious real estate market, we would love to chat. Have a blessed Fourth of July!