In the ever-evolving world of Sioux Falls real estate, the year 2024 holds a promise of exciting opportunities. From shifting loan limits to changing buyer preferences and our exclusive services like Seller Operation Support and Lifetime Home Support, understanding these dynamics is essential for success.

Increased Loan Limits:

In 2024, the Federal Housing Finance Agency has upped the loan limits, reflecting the surge in home values. The new limit for one-unit properties now stands at an impressive $766,550, a remarkable increase from the previous year. Additionally, Federal Housing Administration loans, favored by first-time buyers, now have a limit of $498,257. This boost in purchasing power is expected to empower more Sioux Falls buyers.

Unlocking Home Equity:

U.S. homeowners collectively possess a staggering $30 trillion in tappable equity, averaging around $200,000 per homeowner with a comfortable 20 percent equity cushion. This equity can be utilized for renovations, property investments, debt payoff, or business ventures. Notably, nearly one in four homeowners is considering selling their homes in the next three years, hinting at increased market activity.

Rising Buyer Demand:

With home prices continuing to rise and mortgage rates stabilizing, there’s a surge in buyer activity. This heightened competition might drive prices further upwards, especially as the new year unfolds. In Sioux Falls, local market data shows a 22.3 percent increase in new listings and a 7.9 percent growth in median sales prices. Remember, low inventory often creates more of the same. It’s crucial to work with an experienced real estate broker who’s in the know about off-market sales.

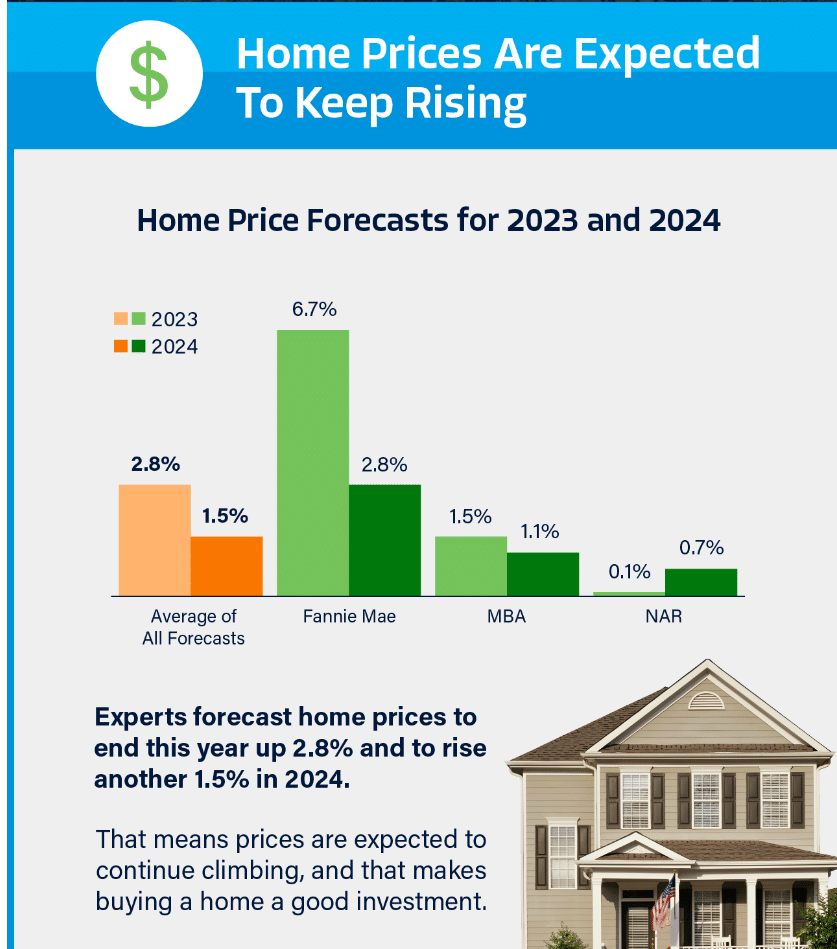

2024 Home Price Predictions:

Expert predictions for U.S. home prices in 2024 vary:

– Goldman Sachs predicts a modest 0.60 percent increase, indicating a stable market.

– Wells Fargo forecasts a 2.5 percent rise, suggesting continued growth.

– The AEI Housing Center projects a robust 7 percent growth.

– Mortgage Bankers Association anticipates a 1.1 percent increase.

– Fannie Mae expects a 2.8 percent rise.

– Zillow estimates a 3.3 percent increase.

Remember, real estate markets are highly localized, so these predictions might not reflect Sioux Falls specifically.

Emerging Trends and Buyer Preferences:

Understanding emerging trends and buyer preferences is key in the 2024 Sioux Falls real estate market. Buyers are looking for:

– Kitchens designed for entertaining.

– Accessible and aging-in-place bathrooms.

– Revamped outdoor spaces.

– Innovative ceiling designs.

– Fun and unique living spaces.

These trends cater to diverse lifestyles and preferences.

Turnkey Properties: A Rising Demand:

Buyers increasingly prefer move-in-ready homes with minimal renovations. This aligns with current economic factors like mortgage rates and construction costs, making turnkey homes more attractive. Properties with modern kitchens, renovated bathrooms, and well-maintained outdoor spaces are particularly sought after.

Seller Operation Support Program:

To meet these trends, our Seller Operation Support program is tailored to help sellers maximize their home’s potential. It offers comprehensive project management, ensuring homes align with current buyer demands.

Lifetime Home Support: An Integrated Approach:

At Amy Stockberger Real Estate, we go beyond buying and selling. Our Lifetime Home Support system provides continuous assistance throughout your homeownership journey, ensuring your property remains a valuable asset in the ever-changing real estate landscape.

Charting a Course for Success in the 2024 Market

As we step into 2024, understanding these trends and leveraging the right support systems are your keys to success in the Sioux Falls real estate market. Whether you’re selling your home or searching for a property aligned with these trends, our team is here to guide you every step of the way.

Check All The Perks Offered At Amy Stockberger Real Estate Here