With the normal ebbs and flows of the real estate market, regardless of whether it is a seller’s market, a buyer’s market or an even market, having a plan in place to build wealth through real estate should be your primary focus. Here are six tips for buyers looking to jump into the market this spring.

Have your lending ROCK solid.

It helps to have your lender not only pre-qualify you but also get you pre-approved through underwriting to make your offer more desirable. The less risky you are to the seller, the more desirable you are to them. I advise my sellers that while the obvious primary goal is to get them the most amount of money in the shortest time, we also want to do so with the least amount of hassle while mitigating risk as much as possible for them. Humans are innately prone to taking risk, and when you throw in high-ticket price items and the natural emotions that come with buying a home, it can be a recipe for disaster unless we mitigation risk-prone buyer financing.

Make sure you are staying current on mortgage interest rates.

This spring, we have seen mortgage interest rates creep up, reporting a touch above 4.75 percent today for a 30-year mortgage. Freddie Mac reported rates rising 1.4 percentage points since January, resulting in the highest rates we have seen in three years. Does this change the monthly budgets you have in place? Does this change your urgency to get into the market to keep those budgets in place? Home prices are continuing to tick up; the Realtor Association of the Sioux Empire published the median home price has increased over 11 percent in the metro area year over year.

You do not need 20 percent of the purchase price for a down payment.

Down payments can be as low as 3.5 percent to 5 percent. The 20 percent down payment would allow you to not carry private mortgage insurance, which adds to your monthly payment, but from an investment standpoint, with home prices rising over 10 percent each year, it would only take two years to remove that PMI and likely save you far more money than waiting to buy knowing that home prices and interest rates will continue to go up, losing you buying power.

Your offer doesn’t have to be the highest-priced offer for the seller to choose you.

Your offer just needs to be the one that makes the seller the most amount of money with parameters that fit their needs and is the least risky. Sound confusing? Let me break it down. The seller and buyer each have their own closing costs associated with the transaction. Instead of increasing your sales price, keep your monthly payments lower by offering to pay some of the customary seller-paid closing costs. At the end of the day, the seller will be comparing all offers against what their walk-away number is, their net number. Amy Stockberger Real Estate has had great success in negotiating this for our buyers. It lessens the risk of appraisal issues, it lowers the buyer’s monthly payments instead of inflating the price too far above market value and makes the seller more money. Expertly negotiating a transaction is our specialty.

Not all information is created equal.

It is imperative that you are using the most up-to-date home listing platforms for new listings hitting the market. Homes are still selling at record speed in most price points, so timing is everything. That’s another crucial reason to be working with an experienced Realtor. Your Realtor can send you the Homesnap app that is tied directly to the Realtor Association of the Sioux Empire so the data is updated straight from our local MLS within minutes. Data from other sources is reporting homes for sale that have been under contract for days, sometimes weeks. This causes so much frustration for buyers when they call in extremely excited to go see a home that is already sold. Homesnap also allows us to communicate directly to our buyer through the app, so we can get them into homes as soon as possible. Click here to download the Homesnap app to be in the know on all new listings.

If you are deciding between buying or renting, make sure you have a clear understanding on what the rental rates look like right now.

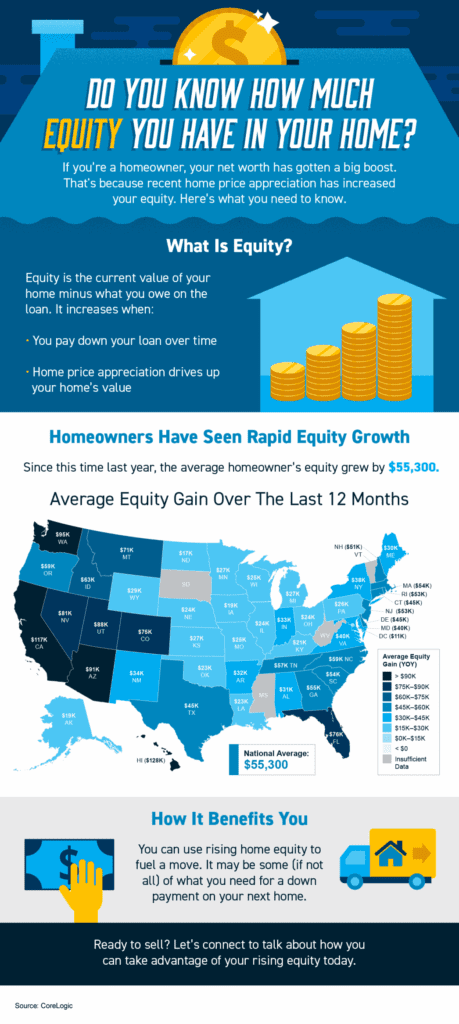

The rental market has seen monthly rental prices go up as high as 19 percent in some areas. With home appreciation at an all-time high, even if you are planning on staying in a home for less than two years, buying instead of renting makes more sense than ever. The same applies for the kiddos heading off to college. Housing price increases have put far more money into sellers’ wallets than ever before, which provides them ease in down payments but also more real estate investment opportunities.

With most homeowners having more equity in their home than ever before, it makes more sense to pull equity out of your home to put in an investment property for those college kids to rent back from you. With the rental market bringing in more income, it also makes sense to increase or start your real estate portfolio. VRBO and Airbnb investments are smoking-hot right now with the popularity of short-term rentals in our area.

Bottom line, you need someone who is an expert with a proven success track record in connecting buyers and sellers to get your goals achieved and exceeded. Amy Stockberger Real Estate would love to help you set up your plan, build your wealth through real estate and be your Lifetime Home Support Partner.