Look out onto gorgeous Prairie Green Golf Course in a home filled from top to bottom with every amenity and upgrade. The six-bedroom, seven-bathroom home at 324 W. Laquinta Circle offers 8,200 square feet of beautifully finished space. “The home is just immaculate,” listing agent Amy Stockberger said. “There are features here you rarely find in a home this well-built…

By Amy Stockberger The definition of market value is what a buyer is willing to pay, but there is an art to pricing a home so that money isn’t left on the table while keeping the price within reach of the appraisal. It’s an art that an algorithm in a computer software cannot navigate, an art that only arrives with…

This sleek but inviting home will wow you with its design and lead you straight to the legendary Old Orchard neighborhood. The two-story home at 2704 E. 33rd St. includes four bedrooms, four baths and nearly 4,400 square feet. “This is definitely a total-package home,” listing agent Amy Stockberger said. “It’s rare to have something available for those who are looking…

By Amy Stockberger I have spent my entire real estate career — my only career, mind you, so I don’t have anything to compare it against — advertising listings for sale because that is the rule book I was given. I go to great lengths to make sure my listings — the product — are as shiny and desirable as…

By Amy Stockberger, Amy Stockberger Real Estate I’m going to be real with you: If you’re in the market to buy a home right now, you need a bulldog on your side. We’re experiencing so many multiple-offer situations, if you’re the buyer you need an agent negotiating for you that has the moxie and empathy to understand how important this…

By Amy Stockberger The recent quintessential holiday of summer is one of my favorites — celebrating all things American, freedom, independence, fireworks, grilling and most importantly time with family and friends. WalletHub estimated that 47 million people traveled 50-plus miles from home over the holiday in 2019 to spend time with family and friends. With our busy work lives, a…

This week’s Up-and-Comer is Katie Day, a Realtor and broker associate with Amy Stockberger Real Estate and the executive director of Almost Home Canine Rescue. Name: Katie Day Age: 38 Hometown: Sioux Falls What brought you to Sioux Falls? I’ve been here pretty much my whole life other than when I lived one year in Madison and three years in Helena, Mont., as…

By Amy Stockberger Is 2020 the year to sell your house? Inventory levels are at an all-time low as well as interest rates, making it a perfect storm for sellers in some price points. The Realtors Association of the Sioux Empire Inc. reported listing inventory being down more than 23 percent at the end of May. Prices also continue to…

As our “new normal” continues to bring all the ultra-freshness of rapid adaptation, wanted or not, we are being blessed with spring. The absence of cold and snow we have been accustomed to in late April was wildly pleasant. For me, 2019 was – at the time – the strangest year I had ever sold real estate. I call the…

First off, I hope you all are safe and healthy. We are praying for you all and are here to help. If you need anything, please let us know. Second, we want to give you an update on what we are seeing in the real estate market and how we are pivoting to match and stay ahead of all of…

As our “new normal” continues to bring all the ultra-freshness of rapid adaptation, wanted or not, we are being blessed with spring. The absence of cold and snow we have been accustomed to in late April was wildly pleasant. For me, 2019 was – at the time – the strangest year I had ever sold real estate. I call the…

There are so many people we’re praying for. All the sick. Their families that can’t be with them. The medical workers on the front line. Those whose jobs have been lost. The businesses that are feeling the sting. And our leaders as they pilot a course they never dreamed would be laid at their feet. We are offering help to…

We as humans have adjusted our expectations of what we deserve - rather, what we demand -- for goods and services rendered. It's not just for high-priced items either. It's anything where we are willing to shell out our hard-earned money. I have been very impressed with McDonalds' business model for most of my adult career. Well, let's be honest,…

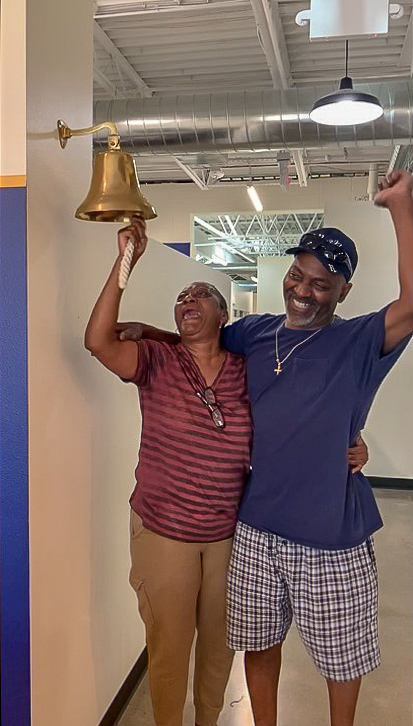

The ASRE Photo Booth We have many creative spaces in our new building. One of those spaces is our Photo Booth Area. We're proud to offer this fun perk to our clients! It serves as a place for clients to take some fun photos (yes, we have photo props!) in celebration of the sale of their home or the purchase…

Check Out Photos of Our New Space As you may have heard, our team recently settled into a beautiful new building unlike any other in Sioux Falls. Our new home is located at 610 W. 49th Street. The space functions as a traditional office with space for our 17 agents and 10 full-time staff. We wanted the space to reflect…

The new office for Amy Stockberger Real Estate is unlike any other in Sioux Falls – and possibly even nationwide. “Our ‘one roof solution’ goal is to have as much as possible under one roof for our clients – to save them as much time, money and stress as possible,” Amy Stockberger said. And the new office delivers. Located in…

Amy Stockberger is out to change the business model of the real estate industry. Later this month, she and her husband, Adam, will launch Amy Stockberger Real Estate, an independent brokerage that she says creates a model unlike any she has seen. “We want to blaze a trail and see where it takes us,” said Stockberger, who began in the…

People move to Sioux Falls, South Dakota, for many reasons. Some like the dry climate and stark beauty of the desert; others are lured by the booming economy or vibrant art scene. If you’re moving to Sioux Falls in the near future or are a resident looking to upscale, what can you expect from the Sioux Falls housing market? Once…

Sioux Falls is having a bit of a boom these days. With its growing economy, vibrant arts scene, and natural beauty, a lot of people are choosing Sioux Falls, South Dakota, as their home. If you're considering moving to our fair city, you will probably hire a real estate agent like the competent professionals on the Amy Stockberger Team. There…

Sioux Falls is a wonderful place to live with its natural beauty, blooming arts scene, and growing economy. The real estate market here is hot with a lot of great properties. You may be considering either remodeling your home or moving. Here are some pros and cons to help you make up your mind. Pros to moving You get to…