Being parents to a soon-to-be 19-year-old and a 6-year-old, we have experienced firsthand the stark differences in their life experiences because of their age gap. The first iPhone wasn’t rolled out until 2007, so videoing our first born, Logan, was done on the trusty but clunky camcorder at first and then the deluxe Mino that fit easily in your hand.

Not nearly as convenient as the iPhone that we have thousands of hours sitting comfortably in the cloud that we can access easily with hours of Legend’s life since birth compared to the videos of Logan that lived in a safe until they recently were converted to digital.

When Legend was a newborn, we had a contraption we could put on his toe to monitor his breathing via an app on our phone compared to just staring for hours at Logan to ensure he took each breath — technology at its best for this mom.

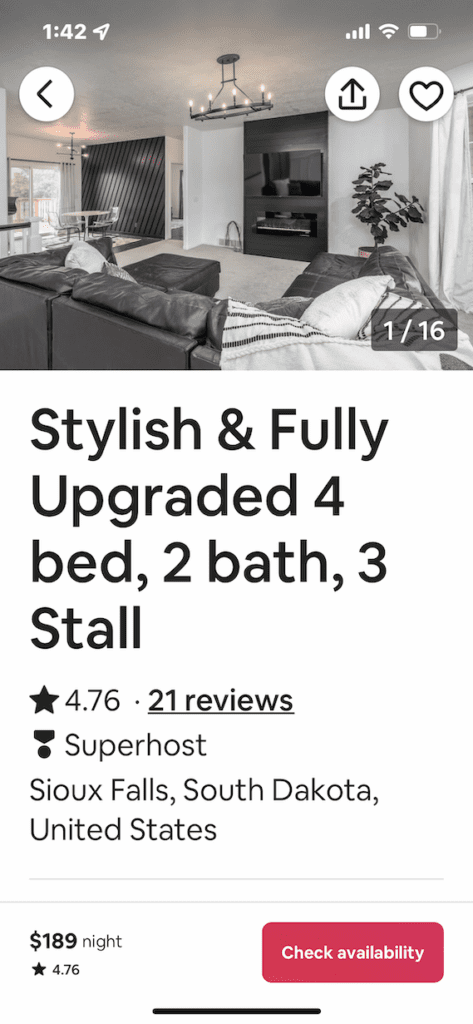

Technology has changed how the world travels, too, which has made our sons’ family getaways very different from each other. With Logan, we stayed in hotels all the time. I have many memories of sanitizing down the remote control as one the first things we did to unpack our little fam into a small hotel room, knowing it would eventually end up in his mouth. Legend, however, stayed at his very first hotel at the prime age of 5. We hadn’t realized it until we were there. It was his first time at the Omaha Zoo, which he loved, but he raved about the hotel. It blew his little beautiful mind. We didn’t stop taking family trips when Legand was born, but the world was just different and we started to just rent a vacation home through Airbnb or VRBO.

Rentals United, a distribution platform for growing property management businesses, estimates that there are at least 1.3 million vacation rentals in the United States. According to the South Dakota Department of Tourism, vacation rental properties are about 2.5 percent higher year over year from 2020 to 2021, and that tracks with what we have seen with our local and out of state investors.

The vacation rental industry is predicted to bring in over $82 billion this year, and savvy Sioux Falls investors are cashing in too. While helping clients build wealth through real estate with long-term investments has been the norm, the pandemic has put Sioux Falls on the radar for investors across the U.S. for short-term rentals because of their typically higher yields.

Here are five reasons why short-term rentals — also termed vacation rentals — are a fabulous investment, not only here in Sioux Falls, but also all around the world.

Equity and leverage

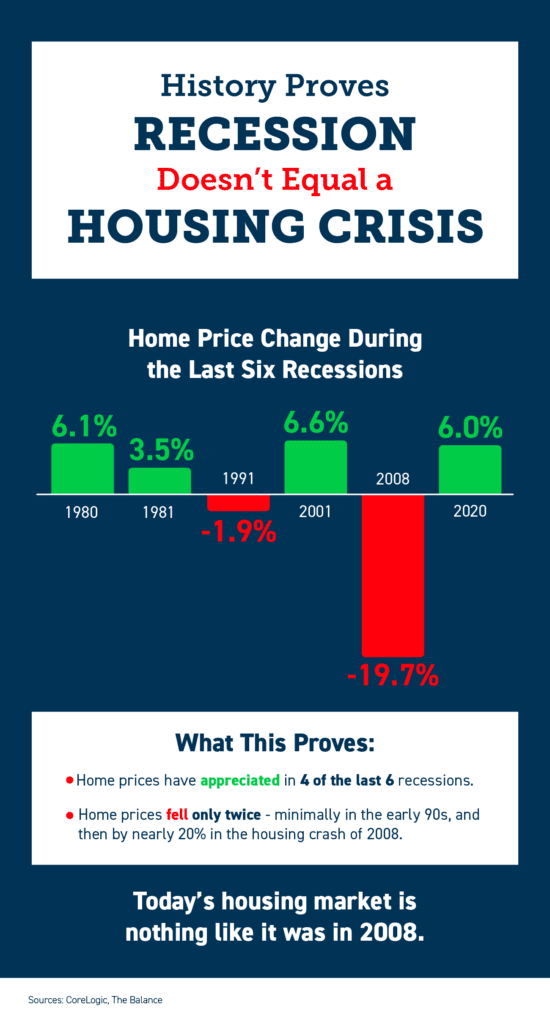

Building wealth through real estate is not only the easiest it has ever been nationwide, but history also has proven that during a recession, the housing market typically flourishes.

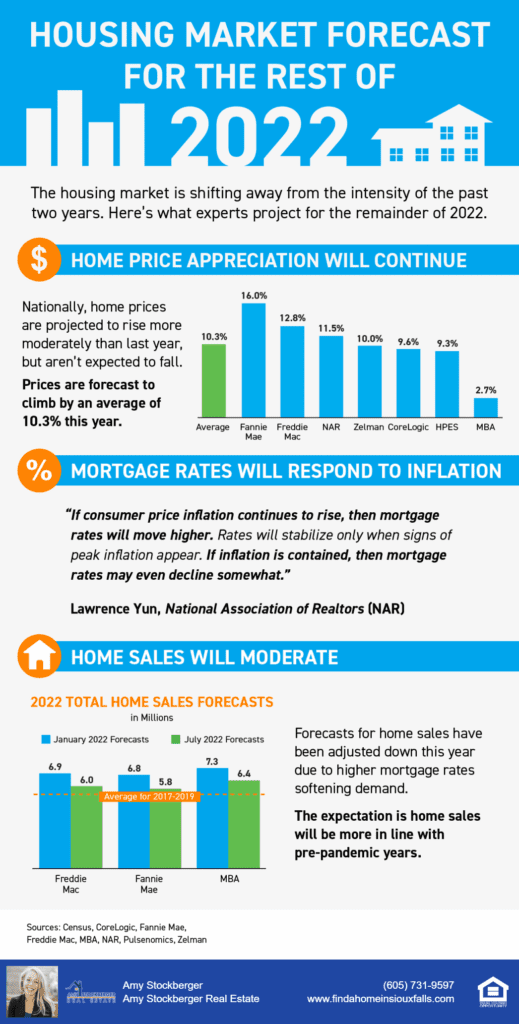

Sioux Falls is reporting 19 percent year-to-date appreciation growth, meaning your property would be worth 19 percent more than it was last year. Your property will continue to grow in value each year, so not only will your short-term rental make you monthly income, it also will grow in value effortlessly. Even with mortgage interest rates normalizing, values are not predicted to go backward, and the nice thing about real estate investments is that your monthly payment remains the same despite interest rate increases if you’re in a fixed mortgage rate. What better way to become an investor than to apply for a mortgage loan to help you build wealth immediately; there are not a lot of other investment strategies that allow for this ease.

As you continue to grow equity in your income property, it allows you to leverage that equity to invest in other income-producing properties using that equity as your down payment for the next property. Helping clients use their own equity to grow their investment property portfolio is one of Amy Stockberger Real Estate’s specialties. We even have an investment group to help match up investors who want to use the synergy of others to grow their portfolios.

Better return than a long-term rental

A short-term rental that is properly marketed typically will yield a better return than a long-term rental. Mashvisor, who does short-term Airbnb and traditional rental analysis, reports that a short-term rental can be two to three times more profitable than long-term rentals. You have more control over increasing nightly rates to match special events and holidays to increase revenue. We have clients whom we have helped buy cabins in the Black Hills that charge $500 per night over the holidays and over $1,000 per night during the annual two-week Sturgis events.

An entire month’s worth of holding costs — mortgage, management fees, utilities and insurance — can be paid for with one stay. That, my friends, is the American Dream, right?

Similar to hotel pricing, the weekend rates are increased as well. Another client has a single-family property in Sioux Falls that nets them on average over $2000 per month.

Also, unlike long-term rentals, with clients staying for shorter time frames it allows you to assess any maintenance issues quicker, which typically can save you money on preventing further issues and repairs.

Long-term rentals undergo the wear and tear of tenants moving large items such as couches and beds in and out of the property while short-term renters are bringing in bags and groceries at most. The cleaning fees needed after each rental are paid by the renter, so that is a wash for the investor as well.

Industry expansion nationwide

From 2011 to 2019, travelers booking vacation rentals increased by 240 percent, according to iProperty Management. The vacation rental industry market value increased over 22 percent from 2020 to 2021, and market research predicts a compound annual growth rate of 8.49 percent from 2022 to 2026.

Because of the increase of remote-working options, families are spending more time on vacations with their children and pets. Short-term rentals provide more comfort for working spaces and space for the family to still enjoy time together.

The largest generation group, millennials, are reported to book a short-term rental over a hotel stay, according to iProperty Management, and make up 40 percent of the leisure travelers who book online.

Rentals United estimates that the number of vacation rental users is expected to be over 893 million by 2026 and user market penetration at 9.2 percent this year, meaning more than one in 10 people have been guests at a vacation rental. The vacation rental market size is predicted to be over $82 billion in the U.S. this year. This trend is not going away and is clearly gaining momentum, especially with more ease of travel worldwide.

Make money and memories

I tell clients all the time how beautiful it is that they are able to make money and memories simultaneously when buying real estate, and while this applies with owner-occupied properties, the same is true for short-term rentals.

It is very common for us to sell short-term rental properties to sibling groups or a group of friends who pool their money together to purchase a property where they not only are collecting monthly income by renting it out but also are using it for family and friend gatherings themselves.

We personally own vacation properties with one of my siblings and her husband and have priceless memories at these properties with our families and have provided a great investment for us all.

Tax advantages

Tax advantages exist with the majority of a real estate investment on the interest paid on the loan, but short-term rentals offer a few more deductions. You can deduct advertising, insurance, maintenance, the furnishings and the property’s depreciation.

Wealth through real estate is one of my all-time favorite things besides my faith and family, and there are so many fabulous opportunities not only in our market with inventory levels increasing but also nationwide.

Finding a property out of state with a direct flight from Sioux Falls allows making memories and money in unison even more appealing. A property in the Anna Maria Island area, close to the St. Petersburg/Clearwater airport in Florida where Allegiant flights are often under $200 round trip, has a 90 percent appreciation year to date. Beautiful investment opportunities.

Grab your friends and family and invest in your future today. Amy Stockberger Real Estate has access to top agents nationwide, so let us know how we can help grow or start your real estate investment portfolio. We also have a step-by-step process to helping you become a Super Host on Airbnb to get your property booked for the highest dollar while gaining five-star reviews.